Part 2 of 5 in The Investment Migration Landscape 2025: A Strategic Recalibration series

Read time: 8 minutes

Let’s take a look at two seemingly identical CBI program applications. The Same $200,000 investment, coupled with the same Caribbean citizenship promise.

Yet, despite the “sameness”, one family will actually save $130,000 while another will wait eight months longer than necessary. Welcome to the new reality of Caribbean-based CBI programs, where standardised pricing has counterintuitively created the industry's most complex market.

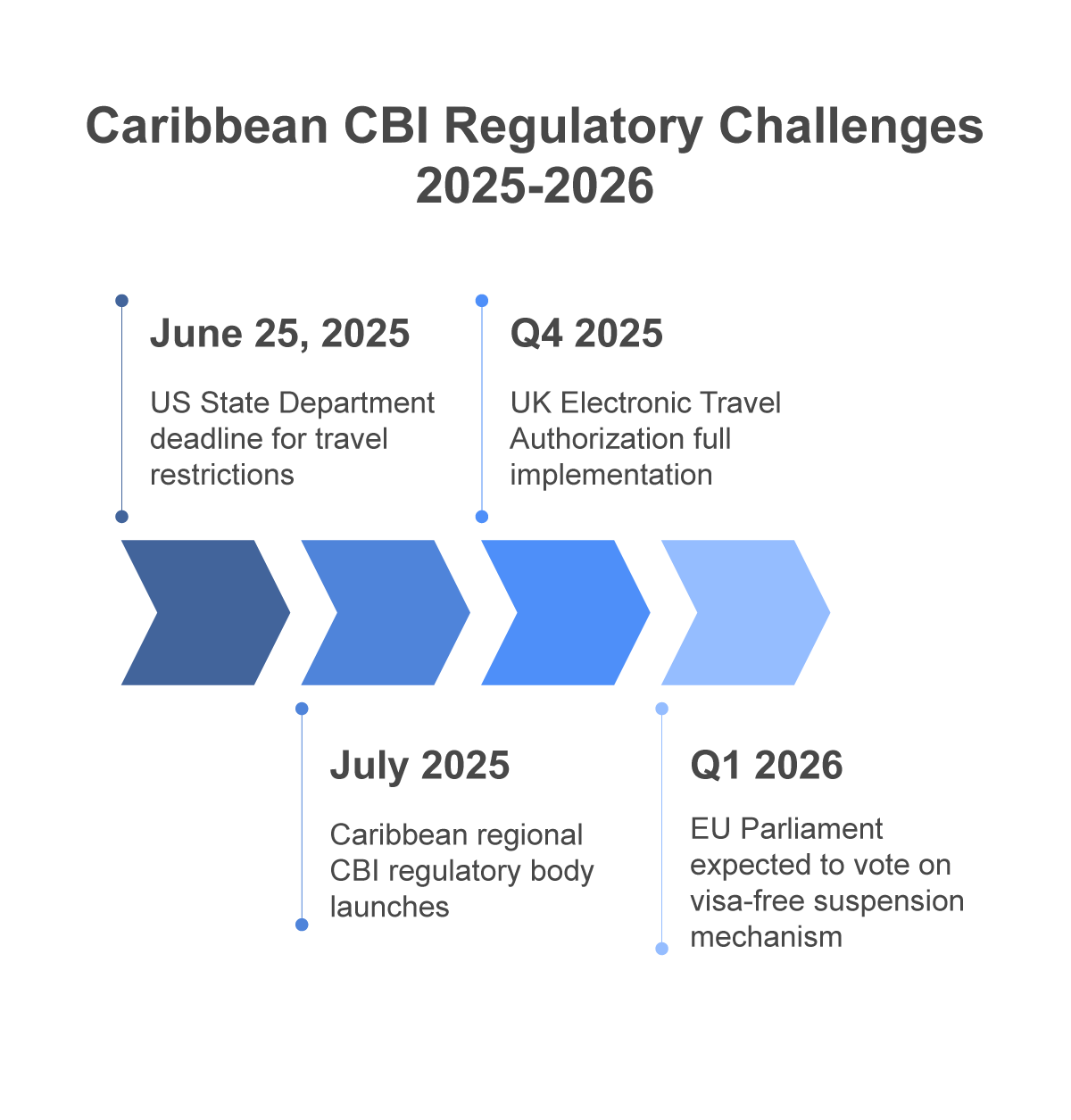

With the US State Department's travel ban deadline approaching (note that the Caribbean government has yet to receive any official communication following the leaked memo) and a regional regulatory revolution set to launch next month, the Caribbean citizenship landscape is undergoing rapid change.

Here's what migration investors need to know.

The Countdown Clock: The Immediate Threats That Are Reshaping The Market

June 25, 2025: The now-past deadline for four of five Caribbean programs to avoid US travel restrictions. The contents of the leaked State Department memo focus on Antigua & Barbuda, Dominica, St. Kitts & Nevis, and St. Lucia. Notably, Grenada was excluded, protected by its E-2 treaty relationship.

While the June 25 deadline has passed, this isn't going away. It's happening, and it's already reshaping application processes as investors rush to secure citizenship before any potential restrictions take effect.

Bear in mind that the US threat is just the opening salvo. The European Parliament's March vote to enable visa suspension for CBI countries passed 41-10, with implementation likely by the first quarter of 2026. The loss of Schengen access would be a hammer blow to these programs' value proposition.

The backdrop of the sameness of Caribbean programs, all being priced at a minimum of $200,000, masks dramatic differences that could cost migration investors time, money, and opportunity.

Speed or Predictability. Which is the New Value Measure

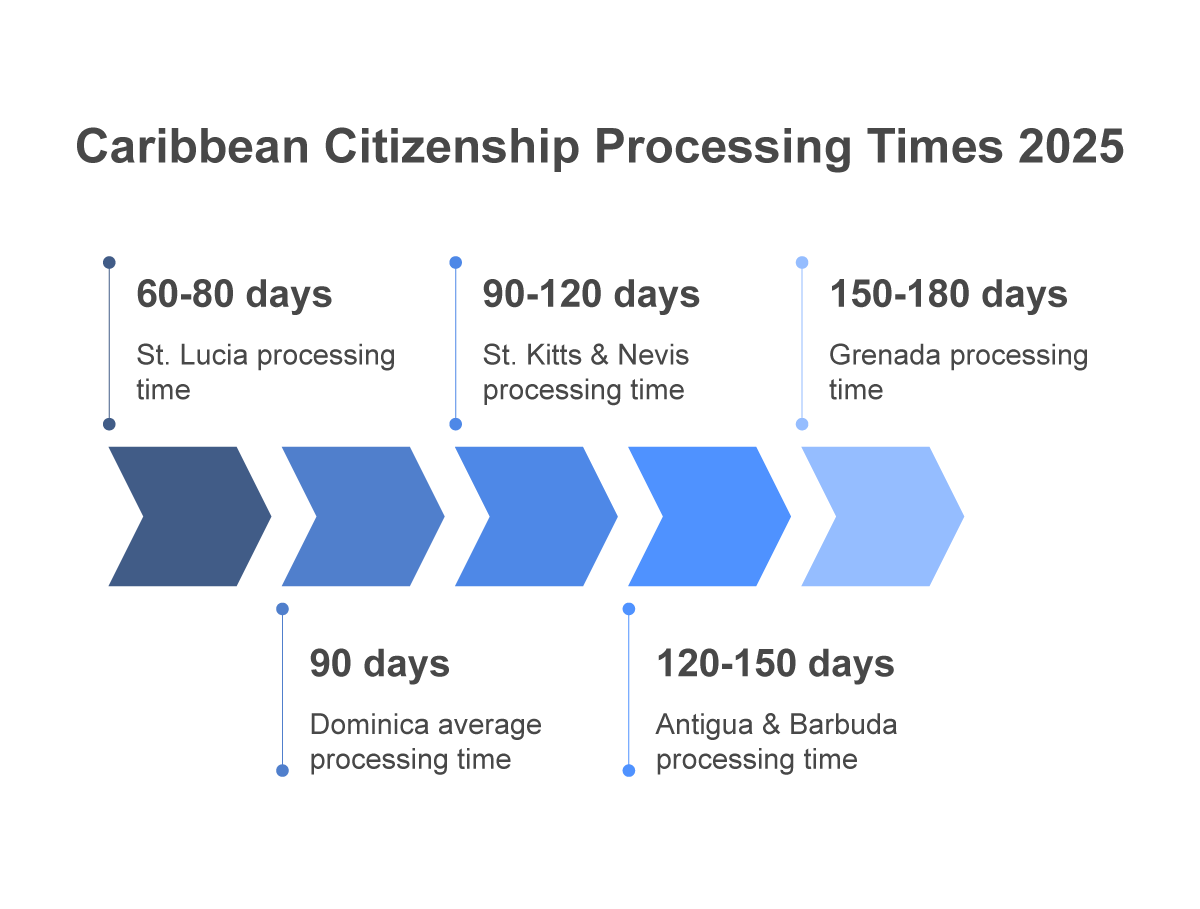

In an unpredictable world where visa policies can change overnight, processing time has become a valid differentiator, and the variance is quite staggering:

PROCESSING TIMES COMPARED:

- St. Lucia: 60-80 days (when not backlogged)

- Dominica: 90 days average (60-180 range)

- St. Kitts: 90-120 days (most consistent)

- Antigua: 120-150 days

- Grenada: 150-180 days

St. Kitts has strategised on winning the overall efficiency battle. By maintaining reliable 90-120 day processing, whereas the competitors can often swing wildly between extremes, they've created a level of certainty in an uncertain market.

St Kitts' efficiency strategy is simple. While Dominica may quote 90 days but deliver in 165, St. Kitts will quote 120 days and deliver in 118. That predictability of processing time is worth far more than the “possible” promise of speed.

The efficiency gap stems from infrastructure, not policy. St. Kitts has invested heavily in a digitalised application system with dedicated processing teams that reflect a decade of operational refinement.

Competitors trying to match these timelines through policy changes alone are discovering an uncomfortable truth: efficiency often requires significant investment.

The Family Cost That Can Make A Big Difference

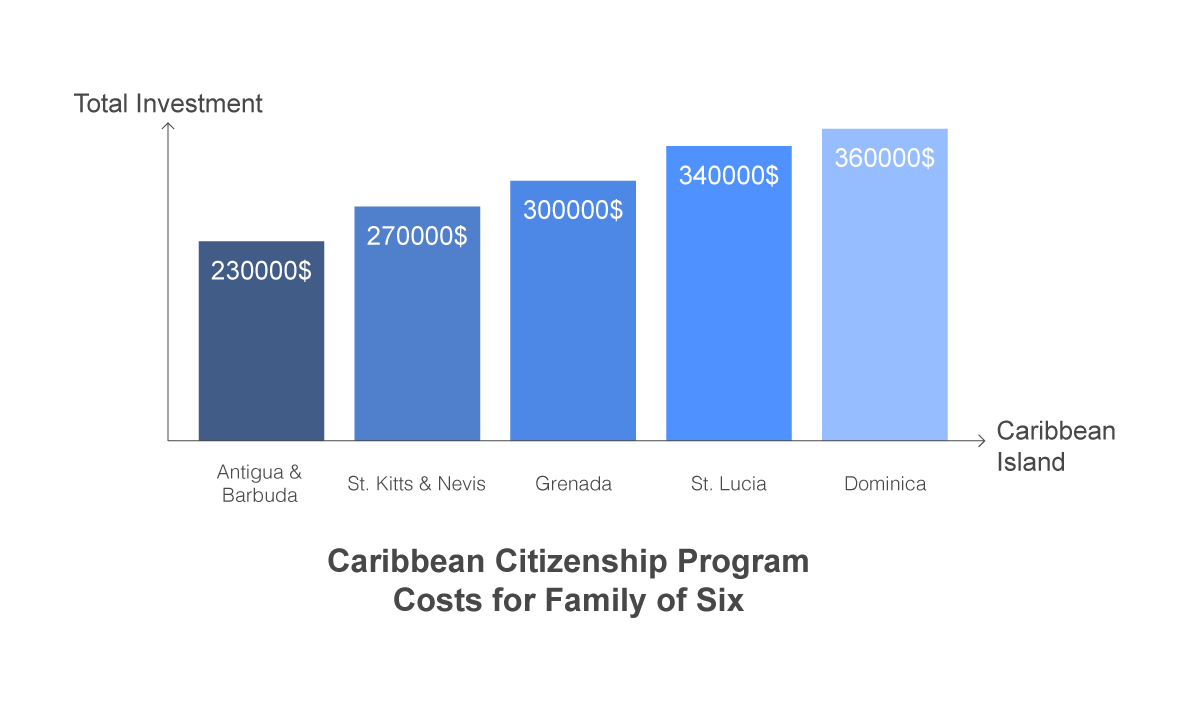

Here's where standardised pricing potentially becomes a misleading trap for the less observant investor.

The real cost of Caribbean citizenship isn't just in the headline number; it's in the comprehensive cost for the entire family.

And we’re not talking about a few thousand dollars either way:

FAMILY OF SIX COST BREAKDOWN:

Antigua & Barbuda: $230,000 (flat rate for four, minimal additions)

St. Kitts & Nevis: $270,000 (graduated scale)

Grenada: $300,000 (includes unique sibling provisions)

Dominica: $360,000 (adds $40,000 per adult dependent)

St. Lucia: $340,000 (complex dependent calculations)

Maximum savings: $130,000

Add to that the fact that the cost is only a part of the equation. The real differentiation lies in who actually qualifies as family:

- Grenada stands alone in allowing siblings, a $50,000+ value for families with multiple adult children

- St. Kitts accepts dependent parents of any age, while Dominica caps at 65

- Antigua extends dependent children’s eligibility to age 30, while most stop at 26

- St. Lucia uniquely includes unmarried siblings under 18

An astute multi-generational family could save $130,000 by choosing Antigua over Dominica. That's enough to fund a child's entire university education. Luckily, the top advisors fully understand that family provisions are where significant sums can be saved or squandered.

Integrity Presented As Investment Insurance

April 2025 marked an inflexion point. St. Kitts revoked 13 citizenships for non-payment of required investments, an unprecedented enforcement action that reverberated through the industry.

Contrary to damaging the program's viability, it triggered an increase in demand.

Why? Because in an era of heightened scrutiny, program integrity has become both the hallmark of quality and the ultimate insurance policy.

Recent actions illustrate the journey investment migration is on. Dominica revoked 68 citizenships in June 2024 for fraud and misrepresentation. Malta's program was declared illegal by the European Court of Justice. Vanuatu lost Schengen access permanently.

Against this backdrop, programs that demonstrate strict compliance aren't only attractive, they’re essential for any country running a program that wants to maintain credibility and a future.

This ethical integrity dividend manifests in measurable ways:

Due Diligence Standards: Dominica's six-tier system, which utilises multiple international agencies, has established itself as the regional gold standard. However, implementation still varies dramatically. Some programs are still relying on single-source checks that wouldn't pass muster at a retail bank.

Political Stability: Grenada's consistent CBI policy across multiple administrations contrasts sharply with St. Lucia's ongoing restructuring amid RICO (Racketeer Influenced and Corrupt Organisations) lawsuits. When your citizenship is at stake, political drama isn't just satirical entertainment.

International Standing: Programs that can demonstrate stronger compliance histories face a 30-40% lower probability of visa restrictions, according to our analysis of regulatory patterns. For an investor, that's the difference between a passport that opens doors and one that potentially raises red flags.

The Hidden Costs of Poor Operations

Beyond the headlines and marketing copy, operational excellence determines the true value of the program. The variance in what might be seen as seemingly minor details creates significant quality differentials:

Document Requirements: St. Kitts requires 12 documents. St. Lucia demands 23. For applicants from jurisdictions with complex apostille procedures, that difference can translate to an additional three months of processing time and $5,000 in additional legal fees.

Communication Protocols: Dominica assigns dedicated case officers who provide weekly updates. Others leave applicants in the dark for months. One investor described the difference as "waiting for your next flight in the lounge or waiting with the cargo."

Post-Approval Services: Antigua's passport renewal takes two weeks by courier. Other programs require personal appearance, international travel, and lengthy queues. Over a passport's lifetime, that can easily add up to another $20,000 in hidden costs.

The additional costs can’t be ignored. Poor operational procedure can add 40% to the total acquisition cost through increased legal fees, higher travel requirements, and reduced opportunity. Astute investors are increasingly calculating the total cost of ownership, not just the sticker price.

Strategic Positioning for the New Reality

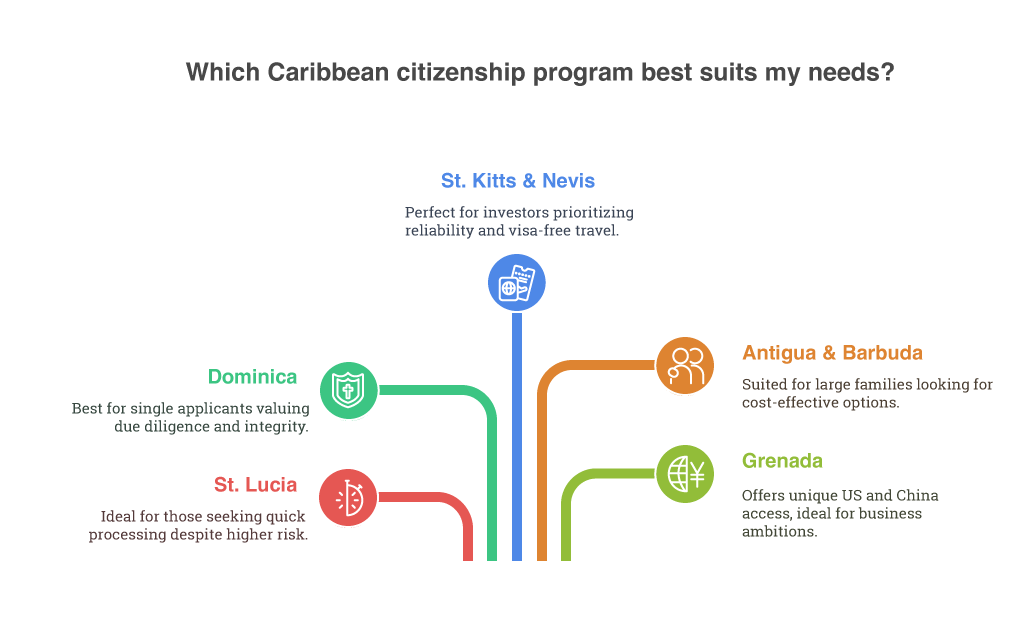

With Caribbean programs now operating with both standardisation and differentiation pressures, clear strategic positions are emerging:

St. Lucia: The Speed Metric

- 60-day processing (when functioning properly)

- Minimal current documentation

- Ongoing legal challenges create uncertainty

- Best for: Risk-tolerant investors prioritising speed

Dominica: The Efficiency Balance

- 90-day average with good consistency

- Superior due diligence infrastructure

- Strong program integrity record

- Best for: Single applicants valuing security

St. Kitts: The Premium Choice

- Most predictable processing times

- Demonstrated enforcement credibility

- 157 visa-free destinations

- Best for: Quality-conscious investors

Antigua: The Family Model

- Unbeatable family economics

- Flexible dependent definitions

- Stable political environment

- Best for: Large or complex families

Grenada: The Strategic Player

- US E-2 treaty access (unique in the Caribbean)

- China visa-free (along with Dominica)

- Sibling inclusion provisions

- Best for: Those with US business ambitions

The Regional Revolution

July 2025 will mark the launch of the Caribbean's unified CBI regulatory body, possibly the most significant structural change in the industry's 40-year history.

This is a major regulatory revolution, not a cosmetic reform supported by a few well-positioned white papers.

The new body will standardise due diligence procedures, coordinate international negotiations, and create a unified defence against visa restrictions.

Looking ahead to the journey moving forward, the regulatory shift has the potential to transform Caribbean programs from perceived security risks to global best practice.

It won’t happen overnight; the challenges are immense. Harmonising the approaches of five sovereign nations while maintaining valid program differentiation requires some very skilled diplomatic gymnastics.

Success has the potential to secure the industry's future and legitimacy, while failure could accelerate its demise.

Looking Forward: The Ever Competitive Frontier

As the traditional differentiators evaporate, the emerging competitive frontier is already developing:

Technology Integration: Real-time application tracking, AI-powered preliminary due diligence, and blockchain-verified documentation will separate next-generation programs from the legacy operators.

Ecosystem Value: Mature, well-developed programs that facilitate complete relocation solutions, encompassing banking, tax residency, and business establishment, will command growing premiums over baseline transaction-focused alternatives.

Community Building: Grenada's annual citizenship ceremonies and St. Kitts' investor forums create alumni networks that now provide ongoing value beyond passport acquisition and are sure to continue growing and developing.

Where Next?

The Caribbean's standardisation hasn't created a commoditised range of indistinguishable programs. Instead, we’re seeing the shift towards operational excellence, family optimisation, and program integrity. These will be the ongoing competitive battlegrounds.

The investment migration marketplace has matured, and as with any mature investment marketplace, the cheapest or fastest option is rarely the best.

The value that investors will seek will come from the alignment of a program's strengths with the investor's personal needs.

With US restrictions potentially looming and the EU decisions just months away, the window for strategic program selection is narrowing rapidly. Investors who understand the real differences hidden beneath standardised pricing will secure advantages measured not in thousands, but in hundreds of thousands of dollars, and years of greater long-term flexibility.

When all programs may appear very much the same on the surface, choosing between them correctly is more critical than ever. Investors who make informed choices will have confidence in their global mobility options. Those who choose poorly could find their new citizenship to be worth far less than the paper it was printed on.

Next: Part 3 - "European Programs: The Great Unbundling"