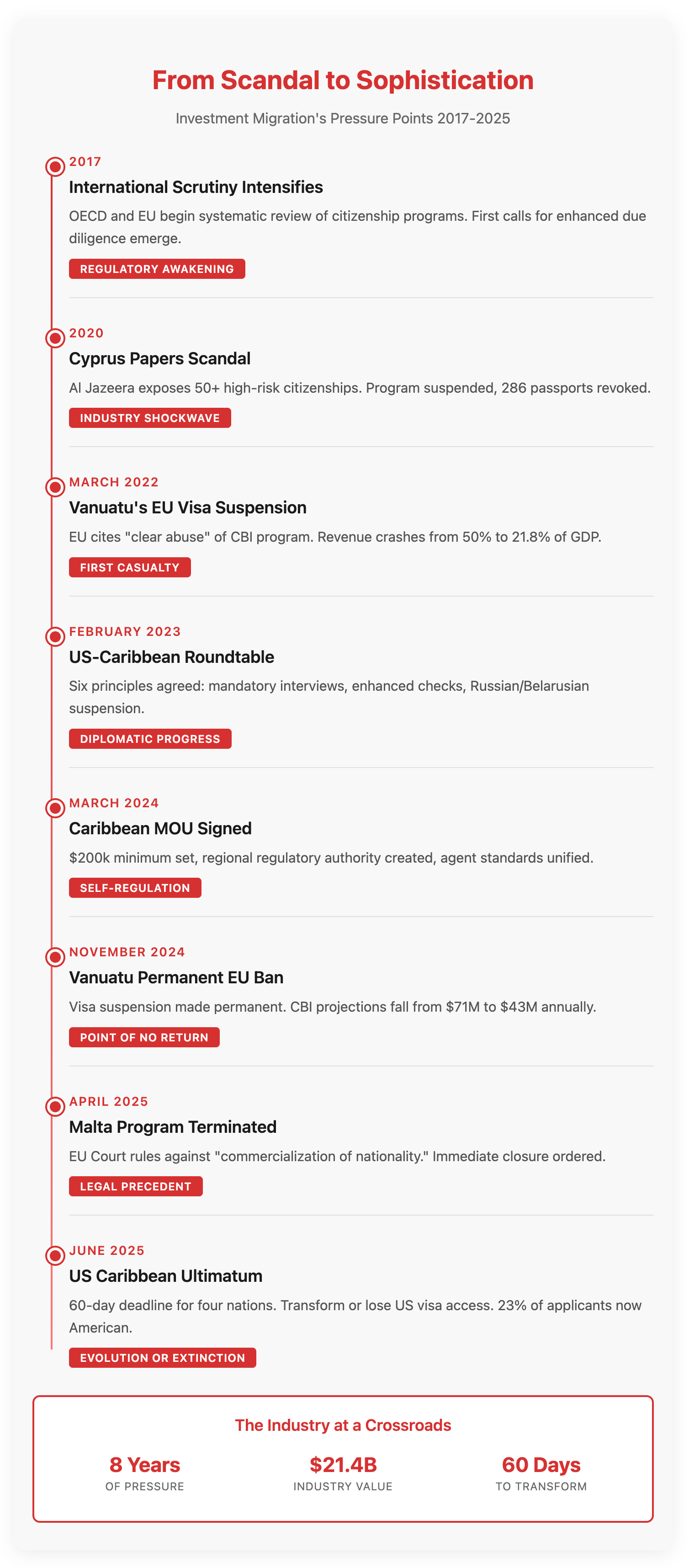

2025 isn't showing any signs of letting up on unexpected events.

In the same year that US nationals became 23% of all citizenship-by-investment applicants, an incredible 1,000% increase since 2019, the US government has given four Caribbean nations just 60 days to overhaul the programs Americans are flocking to join.

The hypocrisy is staggering.

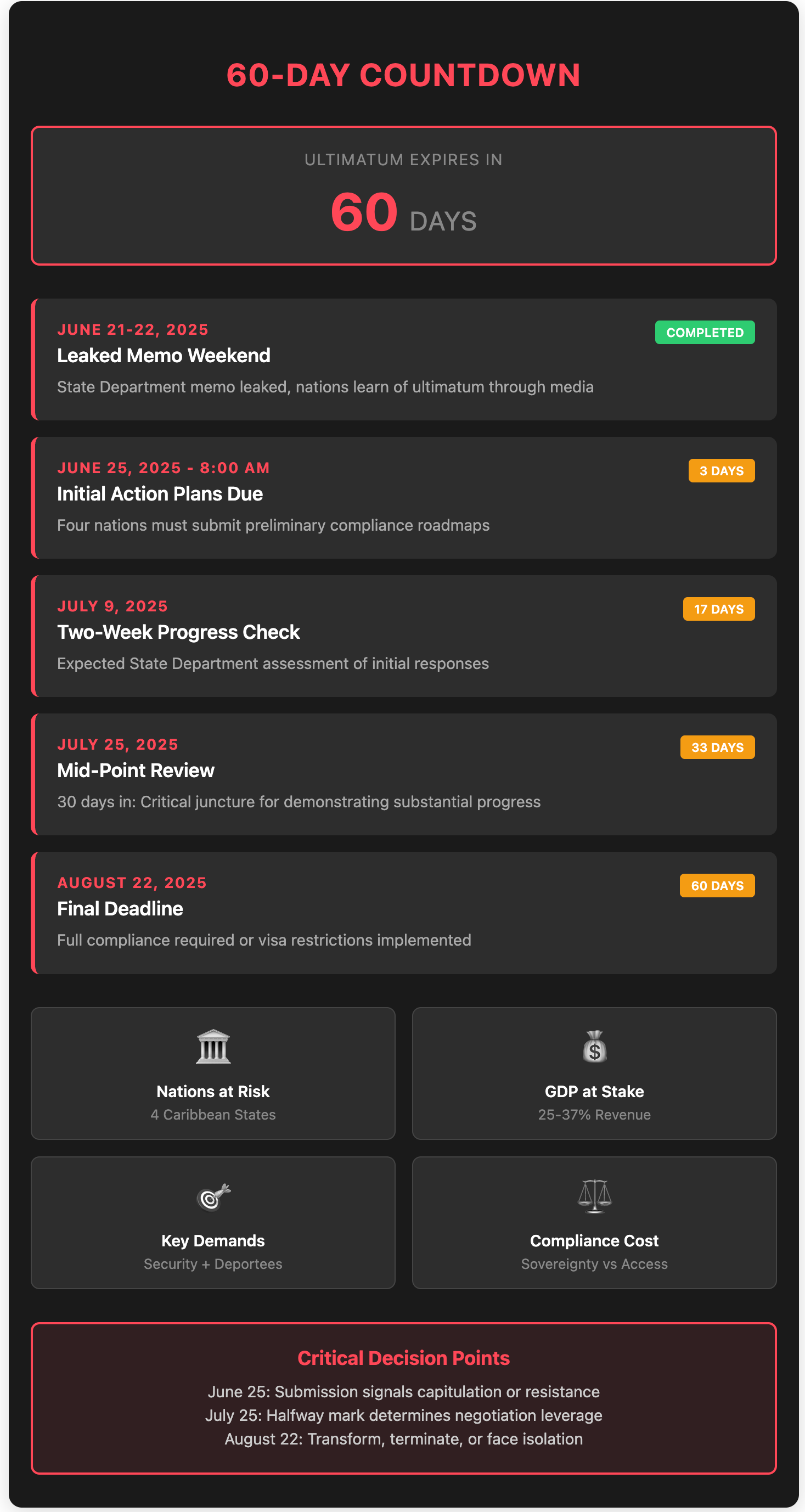

Secretary of State Marco Rubio's leaked memo, delivered over a quiet June weekend with an 8 am Wednesday deadline for response, targets Antigua & Barbuda, Dominica, St. Kitts & Nevis, and St. Lucia, demanding reform or visa bans. Protected by its E-2 treaty relationship, Grenada quietly watches from the sidelines.

But here's what the headlines aren't reporting. The crackdown isn't about security. It's about exercising control. The industry's response over the next 60 days will determine whether investment migration continues its journey towards becoming a mature asset class or remains forever vulnerable to political theatre.

The Contradiction That Exposes Everything

Let's reflect on the ridiculousness of it all. The State Department claims these programs pose security risks, yet it demands that proof of reform could include accepting deportees from third countries.

How exactly does taking America's unwanted immigrants demonstrate bolstered security protocols? Of course, it doesn't. What it does do is demonstrate submission.

The timing tells its own story. Leak the memo on the weekend. Demand initial action plans by 8 am on a Wednesday. Put maximum pressure on nations that generate 25-37% of their GDP from these programs, with just 60 days to restructure them.

This isn't diplomacy. It's designed to destabilise.

St. Lucia's Prime Minister Philip Pierre revealed another tell. Oddly, the ultimatum "did not come up" during his recent meeting with Rubio. When existential threats to sovereign nations don't merit mention in bilateral meetings, you know it's just theatre.

Decoding the Control Mechanisms

Three control mechanisms become crystal clear if we strip away the security rhetoric.

The Visa Weapon: This is basically economic warfare disguised as border protection. Vanuatu learned this lesson brutally when the EU suspension threatened to destroy a vital revenue stream. The threat to suspend tourist, business, and student visas doesn't target security risks; it targets entire populations and economies. Creating a two-tier system where Grenada's E-2 treaty provides immunity while its neighbours face sanctions reveals the game: bilateral submission trumps regional standards.

The Compliance Trap ensures only cosmetic changes are possible. Demanding "initial action plans" within four days practically forces an admission of guilt before any investigation. The 60-day timeline for fundamental restructuring guarantees surface-level responses rather than thoughtful reform, forcing the nations to choose between quick cosmetics or principled resistance. Enhanced requirements favouring large, well-resourced operators will force industry consolidation, and perhaps that's the whole point.

The Sovereignty Test effectively make explicit what's been implicit. Accept US immigration overflow through "safe third country" agreements and surrender your financial privacy through enhanced information sharing, or otherwise face economic strangulation. Antigua's Foreign Minister captured it perfectly: "We will not be bullied." But we know defiance comes at a price.

Why This Ultimatum Might Be a Gift in Disguise

So, how will this really impact the investment migration industry? In truth, this ultimatum might be precisely what the industry needed.

The Caribbean already agreed to work together back in March 2024. Washington has just lit a fire under them. This ultimatum simply accelerates the implementation process.

By late 2025, we'll likely see a full regional regulator, call it the "Schengen of the Caribbean", maintaining individual program identities while sharing standards.

That's not capitulation; it's adaptation.

The quality filter effect could prove game-changing. Enhanced due diligence was coming anyway. The deadline just intensifies the urgency. Integrating blockchain to ensure immutable transaction records, AI-powered screening against global databases, and continuous post-approval monitoring aren't administrative burdens; they're competitive advantages.

The bad actors are forced to exit while the serious operators thrive. It's creative destruction at diplomatic gunpoint.

Most importantly, this could be the moment of legitimacy that the industry has sought for decades. Programs contributing over a quarter of GDP while funding climate resilience and hurricane recovery can no longer be dismissed as merely "selling passports." The shift from defensive justification to offensive positioning starts now.

Reading the 60-Day Tea Leaves

What happens next will signal the industry's trajectory for the next decade.

Watch these indicators:

Unity or Fracture? Do the four nations coordinate their responses or compete for US approval? Early signs are suggesting coordination, with emergency OECS meetings already scheduled. United, they stand a chance; divided, they'll fall one by one.

Grenada's Role may well prove critical. Will they work with their neighbours, leveraging their protected status to help all nations ride the storm, or will they choose to protect their privileged status first?

The answer will reveal whether Caribbean solidarity can survive American pressure over the long term.

Industry Response will separate the wheat from the chaff. Operators who panic-sell should exit anyway. Those doubling down on quality, investing in technology like Exiger's AI-driven compliance platforms, and preparing for higher standards will dominate the next era.

Banking Evolution can't be put on the sidelines. With Wells Fargo and central US banks already rejecting CBI payments, the correspondent banking crisis forces innovation. Watch for bespoke fintech solutions that bypass traditional channels entirely.

The Chinese Counter-Move could reshape everything. Beijing's silence is strategic, not passive. When America weaponises visa access, China looks to the opportunity. Expect alternative financial infrastructure, enhanced diplomatic cover, or competing programs that explicitly reject Western restrictions.

The evolution indicators to track:

- Technology adoption rate in the next 60 days

- Quality of "action plans" submitted by 25 June

- Whether programs raise standards or just prices

- Regional regulator progress acceleration

- New funding mechanisms that can bypass the US financial systems

The Intelligent Investor's Playbook

Any crisis creates an opportunity for those who understand the dynamics.

Here's your strategic framework:

For existing CBI holders: Your citizenship remains constitutionally protected, but its utility faces pressure. The value proposition shifts from visa-free travel to financial optionality and Plan B security. If you hold your CBI for US access, you need to reassess. If you have it for diversification, relax.

For pending applicants: Expect delays but potentially higher-quality outcomes. Programs forced to enhance due diligence may actually increase your passport's long-term value. The question isn't whether to proceed but whether your chosen program will embrace or resist change.

For future applicants: The window for easy, affordable access is closing. Post-ultimatum programs will be more expensive, more exclusive, and crucially, more valuable. If you're ready to move now, you should, or prepare to pay premium prices for premium products.

Strategic insights that matter:

- The programs that embrace transparency will emerge stronger

- The US can't sustain pressure on nations that contribute $1 billion+ to climate resilience

- Generation Alpha's $90 trillion inheritance ensures long-term demand, especially from Americans seeking alternatives

- Quality differentiation finally matters: due diligence leaders will command premiums

- First-mover advantage: Programs that upgrade first will attract premium applicants fleeing the laggards

- Your arbitrage opportunity: investing in programs before they upgrade

The bigger picture: This isn't the end of investment migration—it's the end of investment migration 1.0. Version 2.0 will be more sophisticated, more expensive, and more exclusive. The programs that survive will be those that make control irrelevant through quality.

Theatre vs Reality

State Department spokesperson Tammy Bruce said countries must "convince us that we can trust the process." But trust isn't built in 60 days; it's built through years of careful operation, continuous improvement, and genuine commitment to security.

The Caribbean programs have issued over 50,000 citizenships with minimal documented security incidents. The real security threats come from visa overstays and border crossings, not vetted investors paying hundreds of thousands of dollars.

In 60 days, we'll know whether the investment migration industry has the sophistication to transform political theatre into a strategic advantage. The smart money is betting on evolution.

The real question isn't whether these four Caribbean nations will comply with US demands. It's whether the industry will use this crisis to successfully reposition itself as a legitimate professional service for reputable global citizens. The clock isn't just ticking on Caribbean programs but on the industry's opportunity to be presented in a new light.

And here's the ultimate irony: by forcing this evolution, the US State Department may have just done the investment migration industry the greatest favour in its history. Sometimes, the best thing that can happen to a controversial industry is being pushed to become regulated. Banking learned this many moons ago. Cannabis is learning it now. Investment migration's turn has arrived.

The ultimatum expires in 60 days. The transformation it catalyses could last generations. And that's precisely why June 2025 might be remembered not as investment migration's darkest hour but as the moment it finally came of age.