Part 1 of 5 in The Investment Migration Landscape 2025: A Strategic Recalibration series

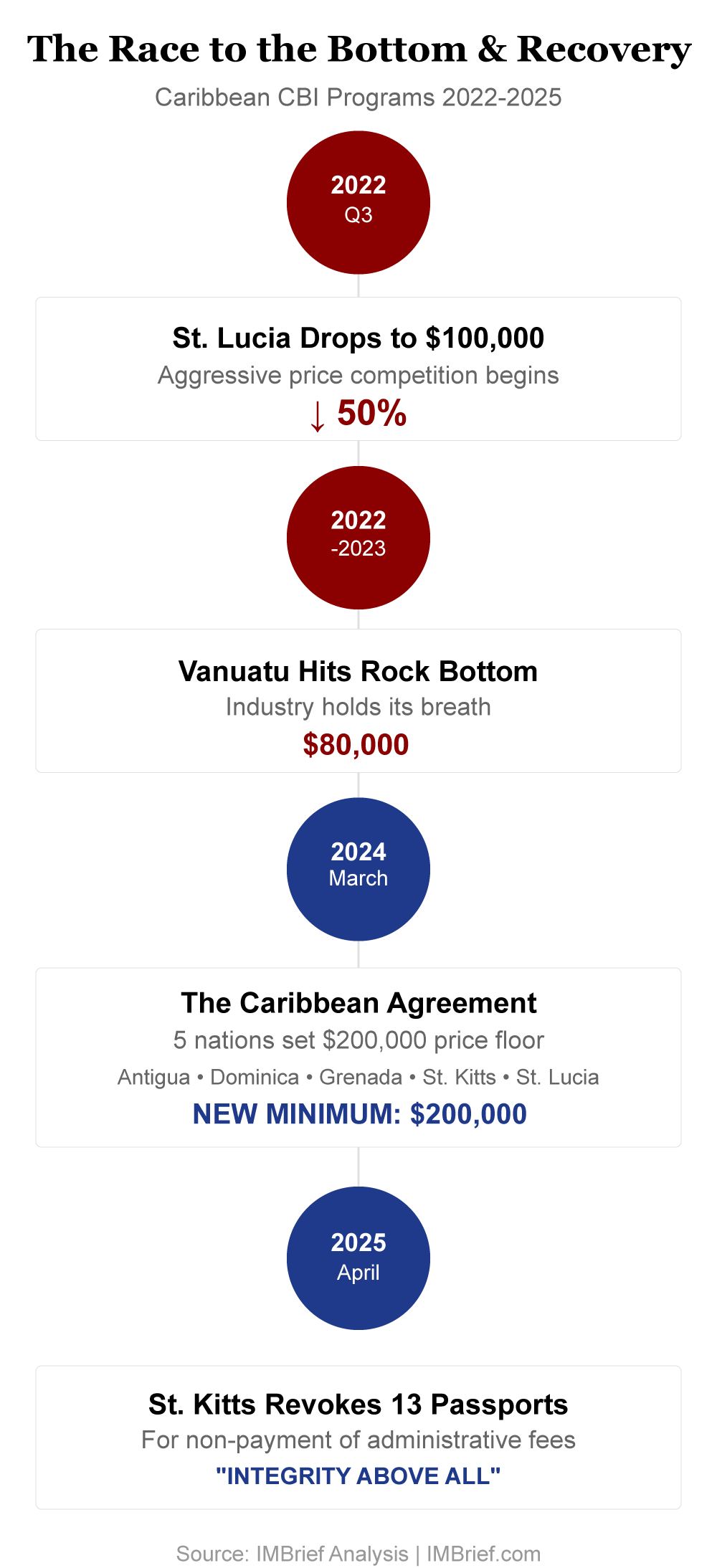

In April 2025, a single event in the citizenship by investment industry marked a seismic shift that points us towards the industry's future.

St. Kitts & Nevis revoked 13 passports for non-payment of fees.

The revocation wasn't due to fraud or suspected criminal activity. No, this was down to an investigation by the Ministry of National Security determining that investors had failed to pay the minimum required statutory investment, despite claiming otherwise.

What we're witnessing here is further evidence that the end of citizenship as a commodity has arrived and is here to stay.

For the past few decades, much of the investment migration industry has operated on a simple premise: find the cheapest legitimate passport, write the cheque, and wait for processing to complete.

With such a premise, the inevitable race to the bottom was utterly predictable. Price-based competition with advisors maintaining spreadsheets to keep track of price fluctuations, operating more like currency traders than strategic advisors. When St. Lucia dropped down to $100,000 in 2022, the competitors scrambled. When Vanuatu hit $80,000, the industry held its breath.

Beyond the revenue loss, the real negative side of the Great Passport Fire Sale was that the intrinsic value of the passports themselves came under scrutiny. It was all too obvious that change was needed if the industry wanted to maintain credibility.

In March 2024, one of the most significant game changes happened. Five Caribbean nations made an unprecedented move in what had become a fiercely competitive market. They agreed to stop competing and set a fixed price floor, cartel-style.

The $200,000 Handshake That Changed The Game

Representatives from Antigua, Dominica, Grenada, St. Kitts, and St. Lucia met to discuss "regional cooperation." What emerged from those talks was effectively a price-fixing agreement, an agreement between previously competing nations that would make cartels like OPEC envious.

It may well be price fixing, but regardless of the definition, it is perfectly legal, brilliantly strategic, and immediately game-changing.

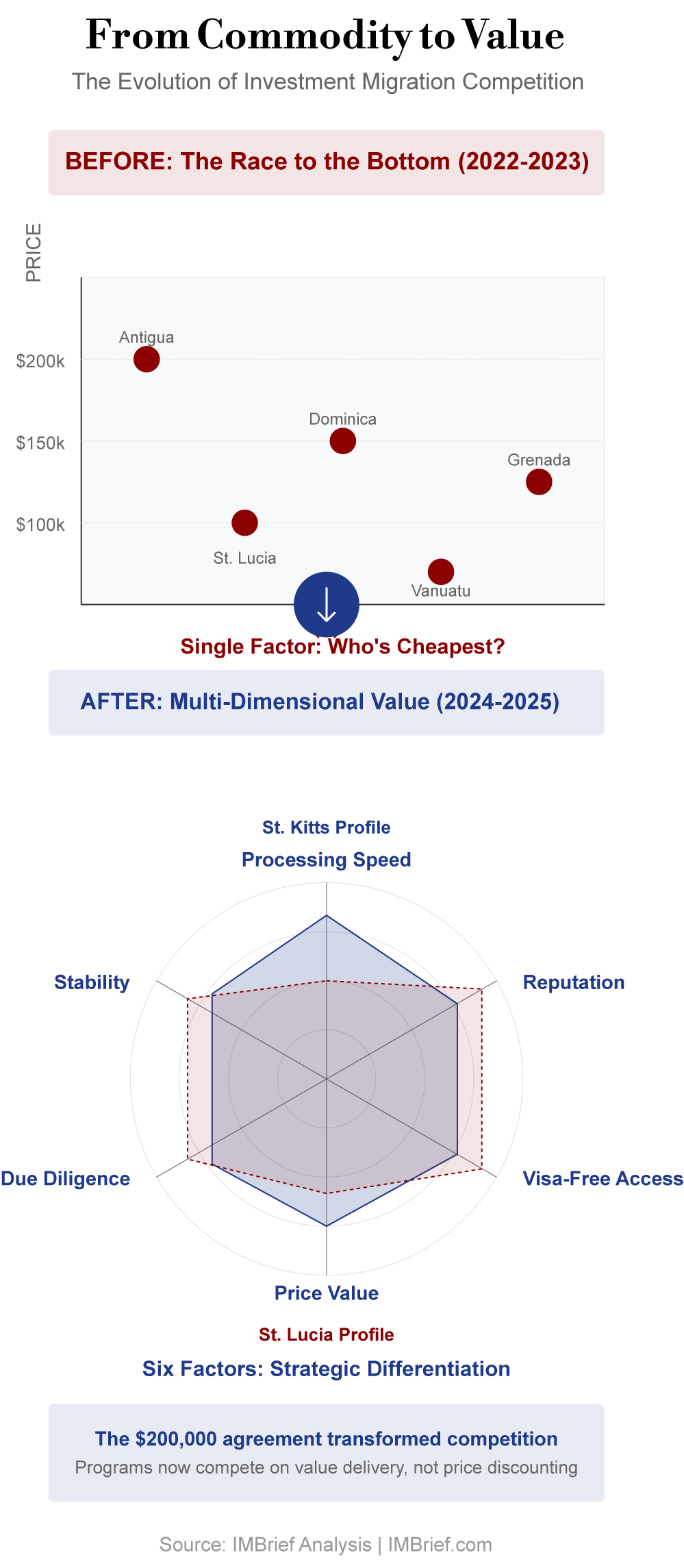

Before the agreement, the Caribbean islands were killing each other. Every time one of the nations dropped the price, applications would reroute in that direction, forcing the rest to reciprocate. There were no winners; each successive price drop attracted further scrutiny and questions about the future of the programs.

The Memorandum of Agreement set a $200,000 minimum for all donation options. Overnight, the fundamental question changed from "Which program is cheapest?" to "Which program is best?" a question that the industry had been sidelining for years.

It took just six months to confirm that conventional wisdom had held its ground. Application volumes hadn't collapsed, and significantly important, program quality was now improving.

The move from a cost-focused market to a value-based market meant that the programs were differentiating in ways that actually matter to applicants.

Investment Migration Repurposed

While the Caribbean created the framework for cooperative and coordinated pricing, Europe has been writing the manual that defines genuine investment.

Portugal ended its golden visa property route in October 2023, Spain followed suit this April, and Greece has tripled prices in prime areas. The message coming from Brussels is loud and clear: stop selling residency to solve the housing crisis.

The headlines focused on the end of residence via property, but they often seemed to miss the bigger picture and the long overdue shift.

Property routes to residency were never really about investment. They were lifestyle purchases with residency benefits included.

A sizable proportion of the clients who selected those programs didn't feel that they were making smart investments in overseas real estate. It was far more about buying an insurance policy that happened to come with a vacation home.

The programs that have survived post-property investment reveal the government's real priorities.

Portugal kept its €500,000 fund option, which today represents a genuine investment that creates jobs and funds research and innovation. Italy maintains its €250,000 startup visa because it wants entrepreneurs, not landlords. The UK's Innovator Founder visa demands robust business plans that would make most venture capitalists sweat.

What's emerging isn't the slow death of investment migration; it's the move to a value-based selection process in a maturing industry.

The Operational Excellence Battle Begins

With aggressive price competition neutralised, Caribbean programs now compete on customer experience and value, something the industry has historically paid scant attention to.

The differences are stark and telling.

St. Kitts processes applications in 90 days. It has invested millions in digital infrastructure that improves government program management efficiency. Every document is digitised, every step tracked, and every decision recorded.

Yet St. Lucia can take up to 10-12 months for the same outcome, not because of outdated technology or cumbersome bureaucracy, but through choice. Their program includes mandatory interviews, enhanced screenings, and what insiders call "deliberate friction" to ensure they achieve quality over quantity.

The spread reveals a fundamental split in program philosophy and marketing strategy. The Efficiency Leaders like Dominica and St. Kitts bet on volume through experience. The Quality Controllers, like St. Lucia, bet on premium pricing through perceived exclusivity. Different features and benefits work for different clients.

Consider a Shanghai-based manufacturing executive who needs Caribbean citizenship before an essential Miami business conference. Time is of the essence; guarantees on processing times qualify the premium charge.

Meanwhile, a Swiss wealth manager is in the process of adding citizenship to his family's portfolio. There's no rush; he'll wait for the "right" program that further enhances his reputation and standing.

The Due Diligence Revolution

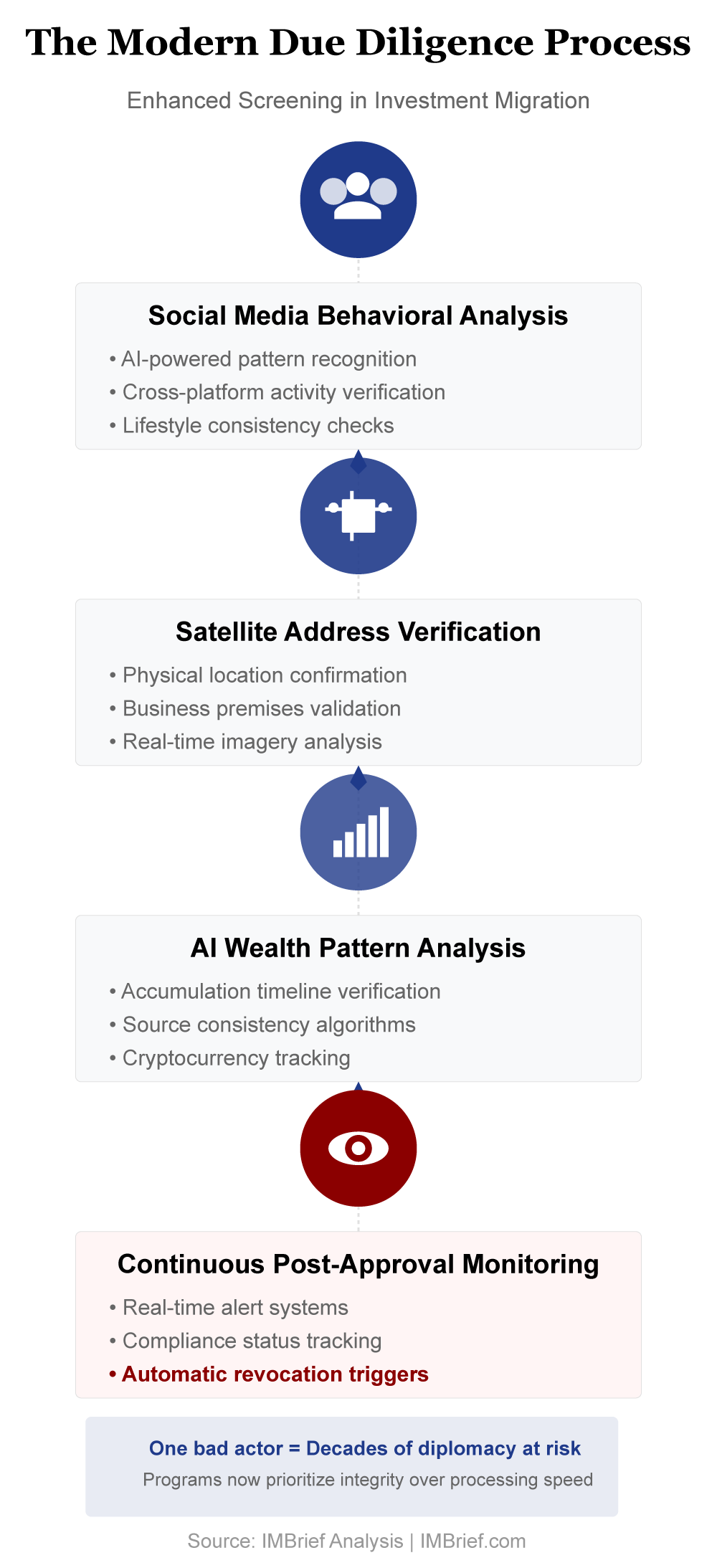

The silent revolution in the investment migration industry is much more significant than improved processing efficiency. It's the change happening in compliance departments. Today, due diligence in investment migration is starting to make private banking look permissive.

Enhanced screening now includes:

- Behavioural analysis of social media patterns

- Satellite verification of claimed addresses

- AI-powered analysis of wealth accumulation patterns

- Ongoing monitoring that continues years after approval

One Caribbean program recently flagged an applicant because satellite imagery showed his claimed "manufacturing facility" was actually a car park. Another caught a discrepancy because LinkedIn activity didn't match his stated travel patterns.

This isn't about an industry that's becoming paranoid. It's about survival.

The EU's pressure on visa-free access obsessively focuses on security concerns. It only takes one bad actor to grab the headlines for decades of diplomatic work to go down the drain. When St. Kitts revoked those 13 citizenships, it sent a message louder than any high-profile marketing campaign could.

That message! "We will protect our program's integrity above all else."

The implications for program applicants are enormous. Complex wealth structures that were once considered routine will now trigger extensive investigations.

Cryptocurrency-based fortunes can require documentation that few thought even needed to exist. Advisors can sometimes spend more time on the source of wealth documentation than on the actual applications.

Winners, Losers, and the Messy Middle

The new landscape creates clear categories:

Winners: Programs with established operational excellence, clear value propositions, and political stability. St. Kitts and Dominica have strengthened their positions. Portugal's fund options are attracting serious investors. The UK and Canada's entrepreneur routes attract continual interest.

Losers: The bargain basement programs that compete solely on price, especially those with questionable political support or those caught in regulatory crossfire. Vanuatu is struggling to establish credibility. Hybrid programs offering neither speed nor strategic value lose relevance.

The Messy Middle: Too many programs are currently sitting in the middle. They're decent options but without any compelling differentiation. They'll survive but probably won't thrive unless they pick a lane: operational excellence, strategic access, or genuine innovation.

2025: The Year of Strategic Selection

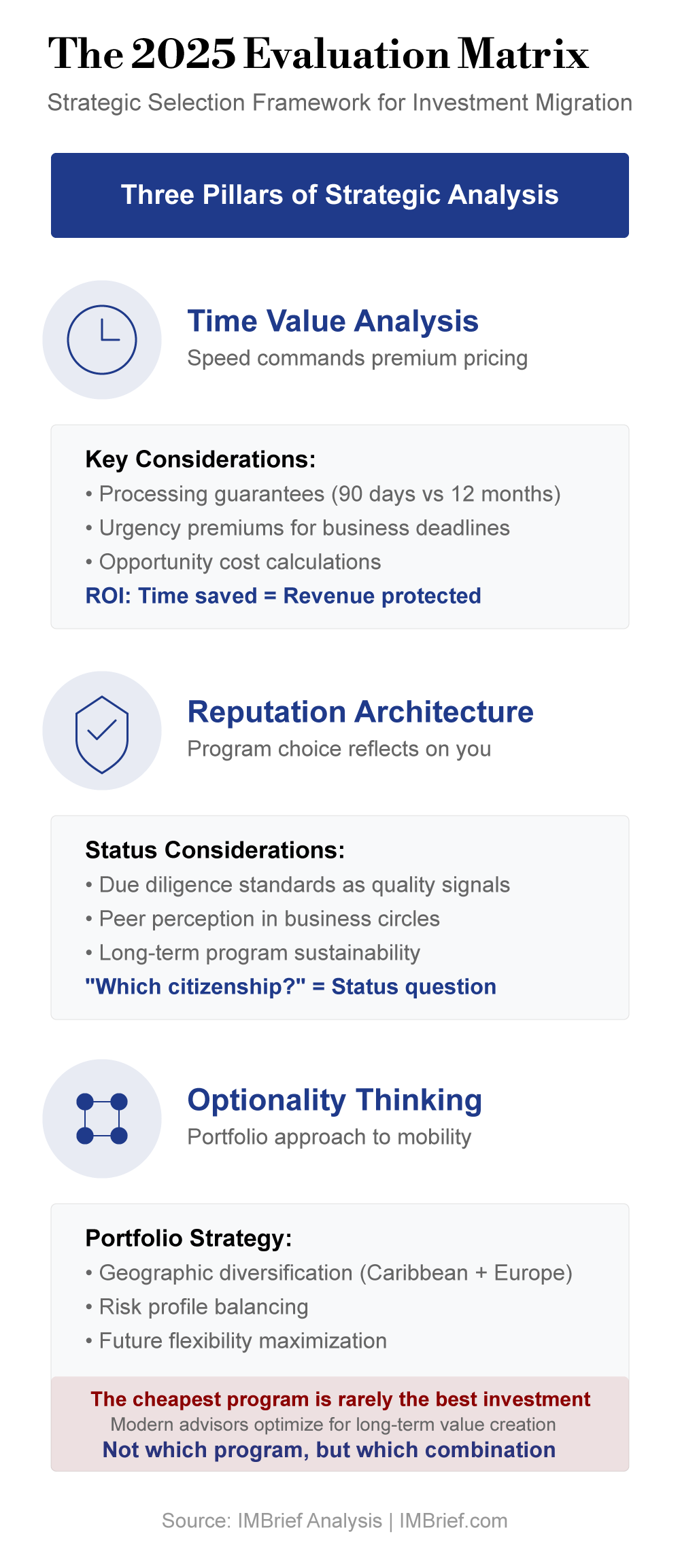

The investment migration industry's shift from a commodity market to a professional value-based service creates new evaluation frameworks:

Time Value Analysis: Fast processing commands premium pricing. For investors who want or need time-based guarantees, the additional costs will justify themselves.

Reputation Architecture: Program choice increasingly reflects on participants. "Which citizenship?" has become a status question in certain circles. Investors will pay a premium for preferential positioning.

Optionality Thinking: Strategic applicants are now building citizenship portfolios like investment portfolios. Their portfolio will be diversified across regions, risk profiles, and time horizons. As with financial investment, the question is not so much which single program but which combination of programs provides the optionality levels the investor wants.

The most successful advisories in 2025 won't be focused on promoting the cheapest programs or the fastest processing. They'll be strategic partners and planners who understand that modern investment migration is about building resilient mobility infrastructure that will withstand an unpredictable future.

The Bottom Line

The end of commodity citizenship is far from being an industry crisis. It's the inevitable evolution towards maturity and professionalism.

As programs develop, standardise their operations, and enhance diligence, they will create sustainable value for all stakeholders. Governments will receive high-value, quality applicants who contribute to the state meaningfully. Applicants, in return, are engaged with programs that provide long-term viability. The industry attains the respectability and credibility it has long sought.

Next: Part 2 - "The Caribbean Convergence: Finding Edge in a Standardised Market"